Next

Back

Prev

UK Profit Monitor 2020

April 2020 / Link Group

UK plc earnings in steep decline, even before COVID-19 recession begins

- UK earnings recession intensifies in Q1 with third consecutive quarter of profit declines – even before COVID-19 effect is felt

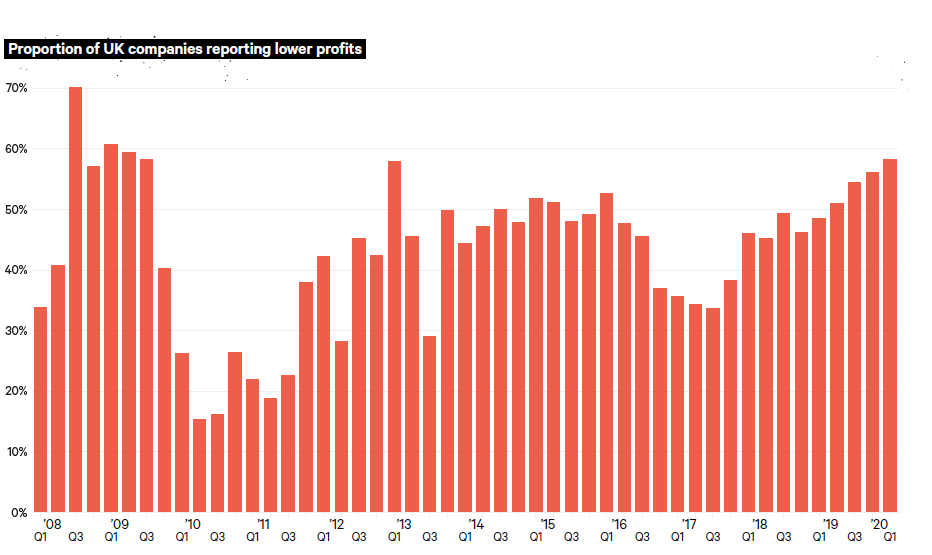

- Only 42% of companies reported rising profits in Q1, the lowest proportion since 2009

- UK profits are a third lower than 2007, after accounting for inflation

- On the eve of the last recession, companies made £14.00 for every £100 of sales; in the last year they have made only £8.30

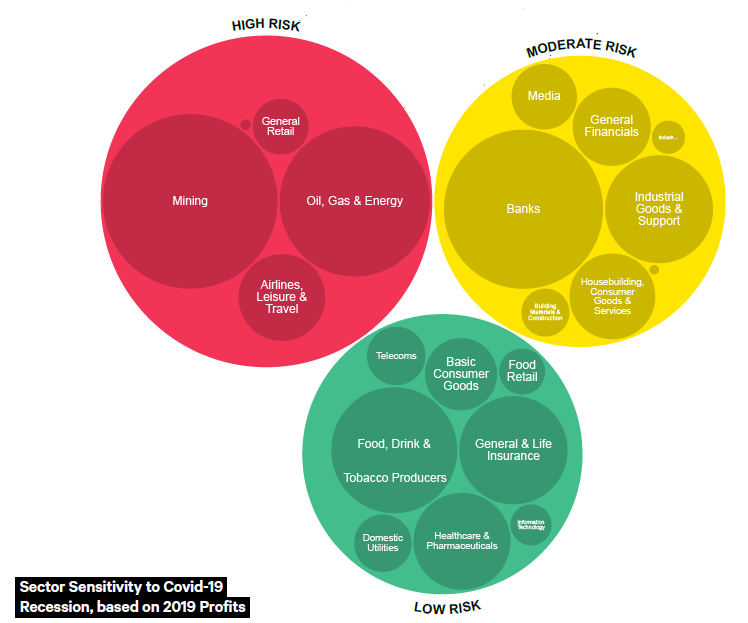

- COVID-19 - Red, amber and green list of vulnerable sectors each represent 1/3 of UK plc profits

- Link shows how COVID-19 could impact UK profits by £170bn over 2020 and 2021

- But the market reaction appears too severe

As the UK’s lockdown intensifies, the new UK Profit Monitor from Link Group shows that the UK’s listed companies face this unprecedented challenge in an unusually weak state. Even before the COVID-19 crisis their revenues and profits were in a prolonged earnings recession. Fewer companies have reported rising profits than any time since 2009. Their profit margins are far below historic highs.

Results reported during Q1 (before any COVID-19 effect hit companies) show that the UK’s listed companies saw revenues fall for the second quarter in a row. There have only been four quarters in the last eight years where the decline in revenues was so broadly spread across different sectors. In Q1, revenues fell 2.4% with the greatest impact coming from the oil sector (suffering lower oil prices even before the price war began), banks, and utilities. As a result, the UK’s earnings recession deepened and widened, with pre-tax profits plunging 29.8% year-on-year. Even allowing for big one-offs, earnings were down for the third consecutive quarter, with the decline affecting large and small companies alike. Moreover, the rate of decline has been accelerating. The UK’s earnings recession has been getting longer, deeper, and broader, even before COVID-19’s impact hit.

This is not just down to a few big companies. In the last quarter, just 42% of companies managed to grow their bottom line year-on-year, the lowest proportion since 2009. This proportion has been in decline, quarter in, quarter out, for two-and-a-half years. At the worst point in the 2009 recession, less than a third of companies reported higher profits. Link Group thinks it will go lower in the recession to come.

If we look at the full twelve-month picture, rather than just the latest quarter, UK companies have booked profits of £166.9bn. That’s 5.7% less than the £176.9bn they made fully twelve years ago in 2007 just before the last recession hit. If we take inflation into account, profits booked in the last year are around a third lower than in 2007. Revenues are three-fifths higher, or one fifth higher in real terms. Profits lagging so far behind revenue growth means margins have much less fat in them than they did ahead of the 2008-9 downturn. Over the last twelve months, UK plc has generated profits of just £8.30 on every £100 of sales, compared to £14 in 2007.

The COVID-19 Recession

Link Group has categorised UK plc’s sectors according to their profit vulnerability to the lockdown. The red list contains critically, directly affected sectors banned from trading or otherwise on the front line. The amber group contains those likely to suffer the second-round effects of the economic hit; they will be affected by falling demand and by supply constraints (including the supply of labour). Those least likely to be affected are on the green list – some of these may even benefit. Each group made up almost exactly one third of UK plc profits over the last year. (The impact on dividends will be different, as Link’s forthcoming Dividend Monitor will set out.)

The exact impact is exceptionally unclear, but it will be large. As a guide, Link Group has looked first at the 2008-9 recession and secondly at the impact of the last collapse in oil and commodity prices. Finally, the team has folded in COVID-19-specific factors such as the hit to retail, travel and leisure. The results of this exercise lead Link Group to pencil in a 75% decline in UK company profits by the autumn this year, before a bounce-back occurs into 2021. This is a hit of £170bn over 18 months, equivalent to a a year’s worth of profit for UK plc.

Susan Ring, CEO of Corporate Markets, authors of the Link Group UK Dividend Monitor said:

“The pandemic has huge social and economic consequences. Firm evidence of how companies are faring will take time to emerge; even profit warnings will only be of marginal use given the rapidly moving situation. This is why the stock market is showing such unprecedented volatility. It is impossible to value companies accurately until investors can nail down with greater certainty the severity and duration of the disruption, and work out how effective the policy response will be from governments and central banks. Share prices are blown from pillar to post as a result.

“Lower profits mean lower share prices are justified. But most of the value of a share derives from its ability to deliver profits over the next 15-20 years, not just from the next year or so. If the damage from the crisis is short-term, and if profits start to rebound later this year, then the elimination of almost £800bn of value from UK stocks during the crash is a clear overreaction to the loss of perhaps £170bn of profits. The gap is the value of uncertainty. COVID-19 will cause a huge amount of economic damage, but does it justify value destruction on this scale?

“All this does not mean the market cannot continue to fall for now. Moreover, if we are set to endure a protracted slump, then our estimates for profits are likely too sanguine. But the recovery will come.”

On dividends, Susan Ring added: “Dividends are a vital anchor in stormy seas. Even in harsh times, companies try to protect the dividend, especially if they think the hit to their profits is temporary. We saw this clearly in the last recession when UK profits fell by two thirds, but dividends only dropped by around 15% peak-to-trough. At the worst point in the financial crisis as the stock market crashed, the yield on UK shares rose to 4.9%. The decline in this recession will be greater. We have seen many dividends delayed or cancelled already as companies look to preserve cash in order to protect themselves against a cessation in business, and there will be much more. If the COVID-19 crisis is short and sharp, we may look back on this moment as a historic buying opportunity.”

Download the full reportOpens in new window